BLOG

2025 Playbook for Remote Landlords

Managing Your Central Florida Rental Properties in a Shifting Market

Managing a Central Florida rental property from afar? You’re in good company. Owning a rental property in Central Florida can be a rewarding investment, even when you live far away.

Let’s be real—owning a rental property in Florida has felt like a golden ticket for many years. For nearly a decade, Central Florida's rental market has been on a thrilling ride. Since around 2015, population growth, skyrocketing demand, and rental rates climbing year after year have created a dream scenario for Florida landlords. From 2020 to 2022 alone, rental prices surged by 36% across Florida, with Orlando, Tampa, and Miami leading the charge.

Today in 2025, while demand remains strong, recent trends indicate a shift toward stabilization. In Orlando, average rents have leveled off, and vacancy rates are beginning to rise as new construction meets ongoing demand.

So, what's a remote landlord to do? It's simply time to adapt and strategize for continued success. This playbook offers practical tips we use to help navigate the changing market, maximize rental income, and ensure investments remain profitable in 2025 and beyond.

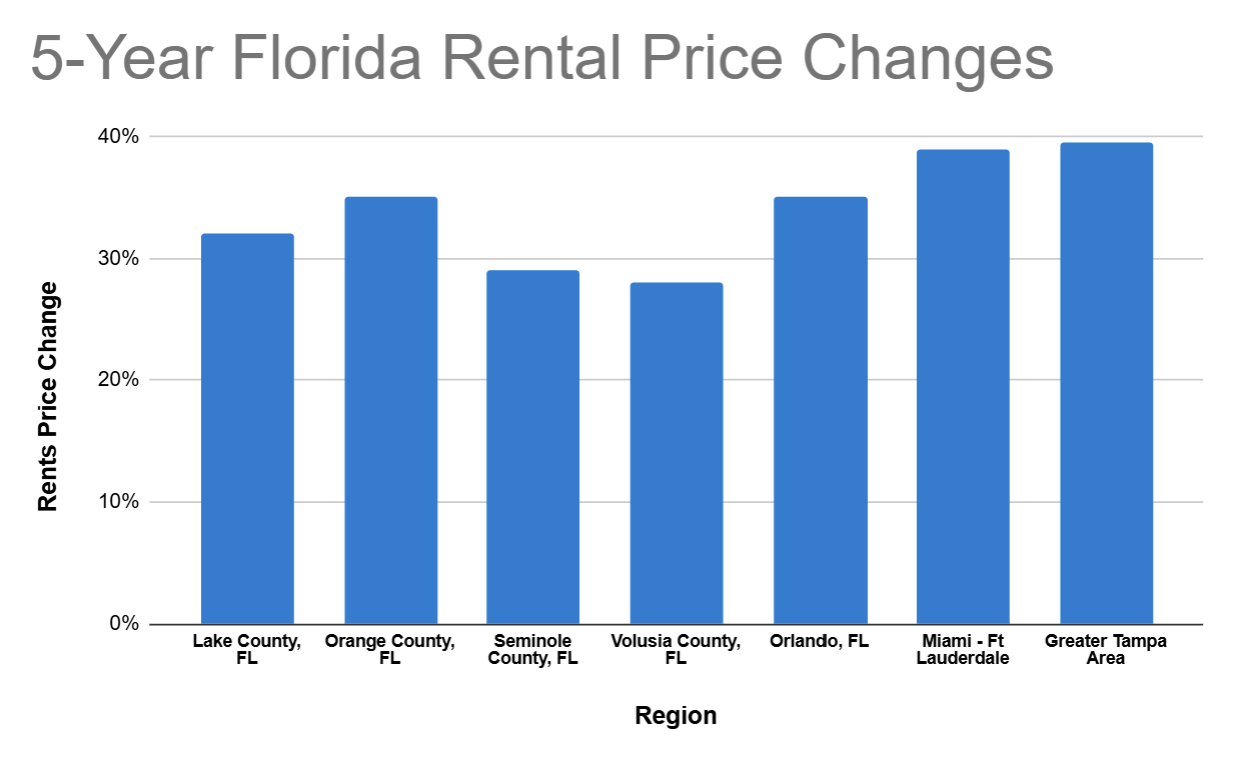

Let’s Talk Numbers: Florida Major Markets & Central Florida Rental Trends Over the Last 5 Years

First, a quick reality check. If you’ve owned your Florida investment property since before 2020, you’ve likely seen some serious gross gains in rents. Personally, since we entered the Florida rental market in 2008, we have seen rents nearly double! According to Zillow and Realtor.com, even over just the last five years, rents have increased substantially.

Source: Realtor.com and Zillow Rental Market Trends

Those are strong increases—and if your rents haven’t moved much in that time, it might be worth re-evaluating. But here’s the thing…

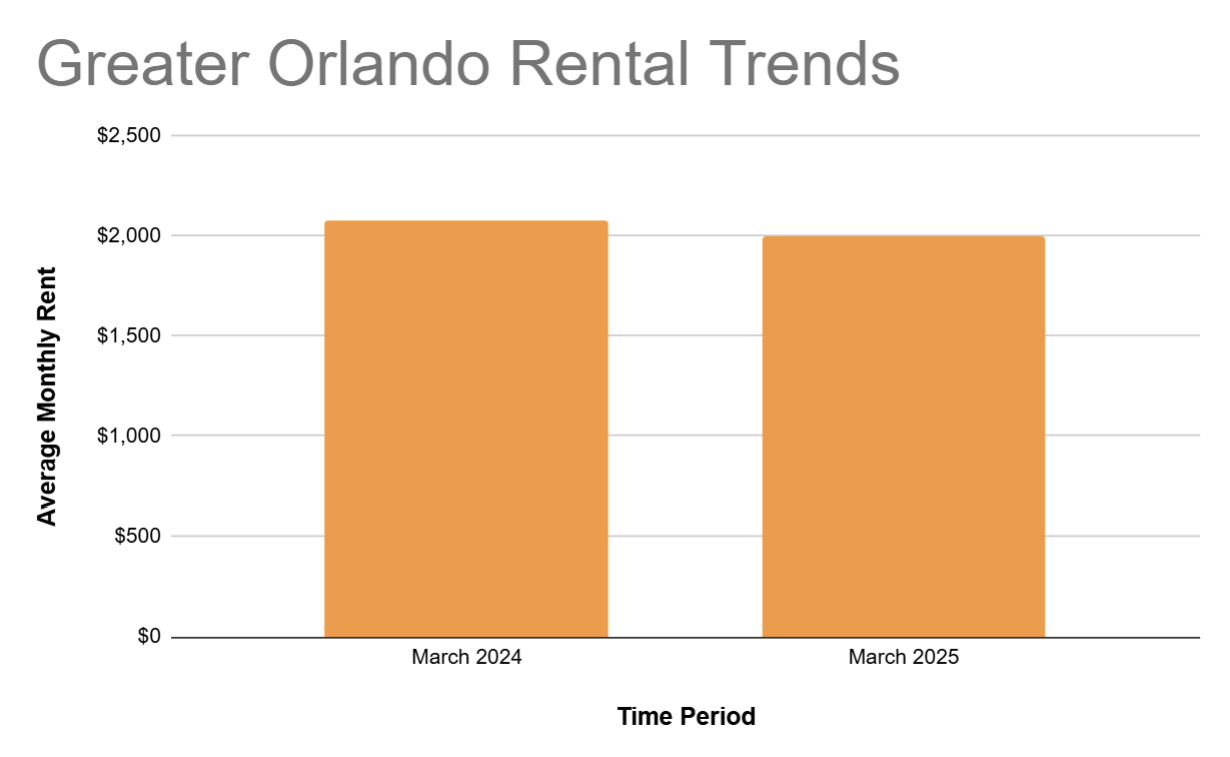

2025 Market Snapshot: Florida’s Rental Market Growth Is Cooling Off

According to Realtor.com's February 2025 Rental Report, rents have begun to stabilize across the 50 largest U.S. metropolitan areas, reaching the 18th consecutive month of year-over-year rent decline nationwide. Comparing the most recent available data from Realtor.com, we see a slow decline in rent prices, indicating a leveling off in the Greater Orlando area:

Source: Realtor.com, Business Insider

This shift is more noticeable for landlords facing rising property taxes, higher insurance premiums, and increased tenant turnover. If you own a rental property in Central Florida, now is the time to think like a proactive investor, not a passive one.

3 Smart Moves for Central Florida Landlords in 2025

What can you do to strategically protect your real estate portfolio, maximize cash flow, and minimize risk of loss today? Here is what we are doing with our Central Florida rental property portfolio in 2025.

1. Re-Evaluate Your Rental Pricing (Yes, Even If You Have a Great Tenant)

It's important to review rent prices

annually

while prices are increasing, but a word of caution, overpricing your rental can also lead to lost income.

Why it Matters:

- Overpricing = Longer vacancies = Lost income.

- Underpricing or Stagnant pricing = Lost opportunity = Lost income.

What to Do:

- Compare to similar listings on platforms like Zillow or Apartments.com.

- Factor in features like size, yard, appearance, schools, and amenities.

- Even a modest $50/month increase = $600 more per year. It adds up—especially if you have multiple properties and/or your property taxes just went up

again.

2. Leverage Local Pros + Property Tech to Reduce Stress

By leveraging professional services and modern technology, you can stay on top of property maintenance, tenant communication, and security—no matter where you are.

- Establish a Reliable, Local Network: Whether it’s a property manager, maintenance, or legal advisor, these professionals understand the nuances of the Central Florida market and can help keep your property in top shape.

- Embrace Smart Home Technology: Consider installing smart thermostats, smart locks, and smart lighting systems to help ensure your property is secure and running efficiently, all while reducing energy costs for your tenants.

- Integrate Automated Tools: Self-managing from a distance? You can use property management software to automate rent collection, maintenance requests, and other routine tasks, with automated alerts to ensure you never miss an important update, whether it's a maintenance issue or tenant concern.

If you are utilizing a property manager, they can provide you with monthly reporting, automated deposits, and loop you into maintenance requests over a set dollar amount to help keep you informed and control costs while minimizing your day-to-day involvement.

3. Tackle Difficult Properties with Proactive Repairs and Strategic Planning

Real estate investing is one of the most powerful paths to long-term wealth, but not every property is meant to be a forever hold. And especially for remote landlords managing Central Florida rentals, knowing when to pivot can make the difference between riding high or slowly bleeding profits.

It might be time to sell your Florida rental property if…

- You're facing major repairs, aging systems, or lingering code violations

- Insurance premiums have ballooned (welcome to Florida’s post-hurricane reality)

- Your equity has grown significantly, but monthly cash flow is shrinking

- You’re losing sleep, time, energy, or patience managing from afar

- Your money could work better in a different market or asset class

Sound familiar? You’re not alone. Florida has seen an impressive run over the last decade, with property values and rental rates climbing steadily—especially in Central Florida. But rising costs and shifting market dynamics are now prompting savvy investors to reassess their portfolios.

Pro Tip:

Properties that have appreciated significantly but require capital improvements are often prime time for a strategic exit.

Wondering, 'Should I Sell or Keep My Florida Rental Property?'

The answer depends on a mix of factors: cash flow, property condition, future rental demand, and how those variables stack up against your personal situation and investing goals. Sometimes the best move is to hold and optimize. Sometimes, it’s to cash out and redeploy that capital into something with better ROI or fewer headaches.

Not sure which side of the fence you’re on? Run a quick profit-and-loss projection with realistic expense estimates—or tap someone who can crunch the numbers for you. The goal isn’t just to hold or sell—it’s to make the smart choice when the time is right.